The Statistical Review analyses data on world energy markets from the prior year. It has been providing timely, comprehensive and objective data to the energy community since 1952. It is completely free for users to access.

The Energy Institute is preserving and building on the Statistical Review’s legacy in collaboration with others. bp is providing continuing support and, as the EI’s Partners for the Statistical Review, KPMG and Kearney are also committing funding and sector expertise.

Data compilation is being undertaken by the Centre for Energy Economics Research and Policy at Heriot-Watt University. An advisory board has also been established, bringing together respected energy thought leaders and experts to provide strategic oversight of the publication.

Verify your email

Download the report

Return Visit — No Re-Verify Needed

There is no single perfect way of accounting for how much overall energy we use. Especially when such dramatic changes are under way. Different methodologies tell us different things about different forms of energy. In addition, not all areas of energy consumption, particularly the use of biomass in residential heating and cooking, are measured accurately or at all.

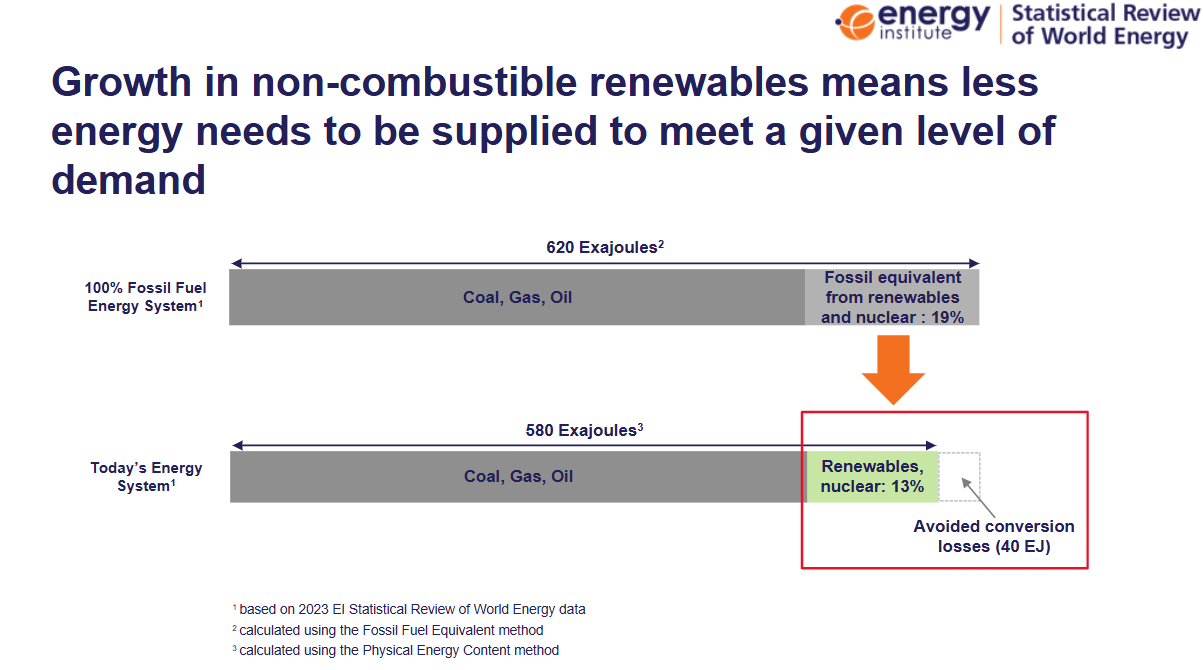

This year the EI Statistical Review uses a new way of reporting the contribution made by non-fossil fuels; an approach adopted by the UN, the IEA, the EIA, bp, and Eurostat. Using the Physical Energy Content method enables us to more accurately reflect the total amount of energy that needs to be supplied to meet final end-use demand.

Nothing. We previously used the method inherited from past reviews to measure primary energy consumption, an approach that views the world through a fossil fuel lens.

That made sense in a world almost entirely fuelled by coal, oil, and gas that included all the losses inherent in producing, transporting, and combusting them. However, this approach treats non-fossil fuels as if they were fossil fuels. For non-combustible renewables, this meant loading onto them the equivalent conversion losses that would have been incurred by their fossil fuel equivalent. As the shares of low and zero-carbon sources of energy have grown over the years, this approach has become increasingly redundant. However, there is still merit using the delta between the old and the new approaches to quantify the benefits that reducing our dependency on fossil fuels has delivered.

For 2023, the previous approach tells us that the world would have needed to supply 620EJ to meet final end-use if fossil fuels had met all demand. In reality, 19% of this was avoided by having nuclear and renewables on the system, inferring an 81% share for fossil fuels.

Wind, solar, hydro, and other forms of renewable energy are not just cleaner than the fossil fuels they displace, they also avoid the need to discover and produce new sources of fossil fuels as they get consumed. As they had continued to grow at a faster rate than fossil fuels, we needed a measure that more accurately reflects the contribution they make in meeting final energy demand. For nuclear, geothermal, and solar thermal, their contribution to the total energy supply is their primary heat input. For non-combustible renewables such as solar photovoltaic, wind, hydro, tide, wave, ocean, etc, their measured contribution is the electricity (a secondary form of energy) that they generate. Fossil fuels are treated exactly as before.

For 2023, this tells us that the actual total amount of energy that needed to be supplied to meet demand was only 580EJ, of which 13% was renewables and nuclear and 87% fossil fuel. The share of fossil fuels appears higher but only because the new approach removes the conversion losses that artificially increased the contribution of non-combustible renewables (mainly hydro, wind, and solar PV).

The new methodology will highlight when total energy supply peaks and starts declining even though final end-use demand may continue to rise. By avoiding the losses associated with consuming fossil fuels, the world’s energy system becomes increasingly more efficient, reducing the amount of energy that needs to be supplied to meet a given level of end-use demand.

We have introduced this new measure in line with similar changes made by the UN, the IEA, EIA, and Eurostat.

We will continue to publish the old primary energy consumption data sets in the Statistical Review data sheet for those users that wish to continue working with them, but our new preferred measure, total energy supply, is far more relevant to a world unlikely to return to a fossil fuel age.

Put simply, in future we will need to supply less energy in the form of clean electricity to undertake the same amount of work as the equivalent energy supplies from fossil fuels. Primary energy demand will decrease as the energy system increasingly electrifies and renewable electricity continues to increase its share of generation. With the new methodology, as we progress through the energy transition and electrify more of our daily lives and economic activity, we will see and be able to accurately measure this change as it becomes increasingly more pronounced.

The energy found in nature that has not been subjected to any human engineered conversion process. It encompasses energy contained in raw fuels and other forms of energy, including waste, received as input to a system. It can be non-renewable or renewable.

Primary energy converted into an alternate, usually transportable, form. Liquid fuels (such as petrol and diesel refined crude oil), electricity, and heat are examples.

Secondary energy that is converted into another form prior to Final Consumption. For instance, coal (primary) can be converted to synthetic gas (secondary) which can be converted to electricity (tertiary).

Includes all the energy produced in or imported to a country, minus that which is exported or stored. It represents all the energy required to supply end users in the country as first recorded in a statistical energy balance.

Represents the energy used by final end users (such as households, transport, industry etc) for all energy uses.

The energy that goes towards the desired output of the end-use application. For a lightbulb, it is the amount of light that is produced. For a car, it is the amount of kinetic (movement) energy that is produced (often expressed as miles driven as a result of consuming the fuel).

The amount of energy saved due to the deployment of non-combustible renewables that would have otherwise been lost (largely wasted heat and mechanical losses) when consuming fossil fuels.

Useful Energy is just a fraction of Primary Energy with losses due to transforming primary energy into secondary (and tertiary energy), transmission and distribution losses incurred during transportation, and equipment loses during final consumption.

Measures primary energy at the first step in the production process where an energy source has a practical energy use and first appears in a statistical energy balance. For non-combustible renewables such as solar photovoltaic, wind, hydro etc. this is their gross electrical output (3,600 kilojoules/kWh). For nuclear and other renewables i.e. geothermal and concentrated solar thermal, it is the energy content of their primary heat inputs. For fossil fuels and biomass, it is the energy content of the primary energy feedstock.

A way of comparing the energy inputs of renewable energy sources, like solar or wind, to the primary energy inputs of traditional fossil fuels (coal, oil, natural gas) by converting renewable energy into a comparable unit using a “fossil fuel equivalency factor” allowing for a direct comparison. It indicates how much fossil fuel would be needed to provide the same amount of energy (usually electricity) as a given renewable source.

The mechanical, radiation, or thermal input energy to a device calculated using technology specific efficiency assumptions. For non-combustible renewables it is as the gross energy that first strikes an energy conversion device i.e. for geothermal, the energy contained in the hot fluid at the surface of the wellbore, for wind, the energy contained in the wind that turns the blades, for solar, the energy contained in the sunlight that strikes the panel or collector mirror etc.

The conversion factors cover calculation between weight, volume and calorific measures. They provide data for crude oil, products, natural gas, LNG, electricity and solid fuels.

Total proved reserves of oil – generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing conditions.

The total oil reserves estimates have been compiled using a combination of primary official sources, third-party data from the OPEC Secretariat, World Oil, Oil & Gas Journal and Chinese reserves based on official data and information in the public domain. Canadian oil sands 'under active development' are an official estimate. Venezuelan Orinoco Belt reserves are based on the OPEC Secretariat and government announcements. Reserves and R/P ratio for Canada includes Canadian oil sands. Reserves and R/P ratio includes the Orinoco belt. Saudi Arabia’s reserves include NGLs from 2017. Reserves include gas condensate and natural gas liquids (NGLs) as well as crude oil.

The data series for proved oil in this year’s Review does not necessarily meet the definitions, guidelines and practices used for determining proved reserves at company level, for instance, as published by the US Securities and Exchange Commission, nor does it necessarily represent the EI’s view of proved reserves by country.

For more information please see oil reserves definitions.

Total proved reserves of natural gas – generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing conditions. The data series for proved gas reserves in this year's Review does not necessarily meet the definitions, guidelines and practices used for determining proved reserves at company level, for instance as published by the US Securities and Exchange Commission nor does it necessarily represent the EI’s view of proved reserves by country.

The total natural gas reserves estimates have been compiled using a combination of primary official sources and third party data from Cedigaz and the OPEC Secretariat.

Total proved reserves of coal – generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing conditions.

Source Federal Institute for Geosciences and Natural Resources (BGR) Energy Study 2020.

If the reserves remaining at the end of any year are divided by the production in that year, the result is the length of time that those remaining reserves would last if production were to continue at that rate.

Percentages have been calculated before the rounding of actuals.

Because of rounding, some totals may not agree exactly with the sum of their component parts.

Metric equivalent of tons.

Country groupings are made purely for statistical purposes and are not intended to imply any judgment about political or economic standings

North America

US (excluding US territories), Canada, Mexico.

Caribbean

Atlantic islands between the US Gulf Coast and South America, including Puerto Rico, US Virgin Islands and Bermuda.

Central America

Belize, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, Panama.

South and Central America

Caribbean (including Puerto Rico and US Virgin Islands), Bermuda, Central and South America.

Europe

European members of the OECD plus Albania, Bosnia-Herzegovina, Bulgaria, Croatia, Cyprus, Georgia, Gibraltar, Latvia, Lithuania, Malta, Montenegro, North Macedonia, Romania, Serbia and Ukraine.

Commonwealth of Independent States (CIS)

Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russian Federation, Tajikistan, Turkmenistan, Uzbekistan.

Middle East

Arabian Peninsula, Iran, Iraq, Israel, Jordan, Lebanon, Syria.

Northern Africa

Territories on the north coast of Africa from Egypt to Western Sahara.

Eastern Africa

Territories on the east coast of Africa from Sudan to Mozambique. Also Madagascar, Malawi, Uganda, Zambia, Zimbabwe.

Middle Africa

Angola, Cameroon, Central African Republic, Chad, Democratic Republic of Congo, Republic of Congo, Equatorial Guinea, Gabon, Sao Tome & Principe.

Western Africa

Territories on the west coast of Africa from Mauritania to Nigeria, including Burkina Faso, Cape Verde, Mali and Niger.

Southern Africa

Botswana, Lesotho, Namibia, South Africa, Eswatini.

Asia Pacific

Brunei, Cambodia, China †, China Hong Kong SAR*, China Macau SAR*, Indonesia, Japan, Laos, Malaysia, Mongolia, North Korea, Philippines, Singapore, South Asia (Afghanistan, Bangladesh, India, Myanmar, Nepal, Pakistan and Sri Lanka), South Korea, Taiwan, Thailand, Vietnam, Australia, New Zealand, Papua New Guinea and Oceania.

† Mainland China

* Special Administrative Region

Australasia

Australia, New Zealand.

OECD members (Organization For Economic Co-operation and Development)

Europe: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, UK.

Other member countries: Australia, Canada, Chile, Colombia, Costa Rica, Israel, Japan, Mexico, New Zealand, South Korea, US.

OPEC members (Organization of the Petroleum Exporting Countries)

Middle East: Iran, Iraq, Kuwait, Saudi Arabia, United Arab Emirates.

North Africa: Algeria, Libya.

West Africa: Angola, Equatorial Guinea, Gabon, Nigeria, Republic of Congo.

South America: Venezuela.

European Union members

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Republic of Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Non-OECD (Organization for Economic Co-operation and Development)

All countries that are not members of the OECD.

Publishers are welcome to quote from this document provided that they attribute the source to the Energy Institute Statistical Review of World Energy 2023. However, where extensive reproduction of tables and/or charts is planned, permission must first be obtained from:

Email: [email protected]

Traditionally, in the Statistical Review of World Energy, the primary energy of non-fossil based electricity (nuclear, hydro, wind, solar, geothermal, biomass in power and other renewables sources) has been calculated on an ‘input-equivalent’ basis – i.e. based on the equivalent amount of fossil fuel input required to generate that amount of electricity in a standard thermal power plant. For example, if nuclear power output for a country was 100 TWh, and the efficiency of a standard thermal power plant was 38%, the input equivalent primary energy would be 100/0.38 = 263 TWh or about 0.95 EJ.

For many years, the efficiency of this standard power plant has been assumed to be 38%. However, in reality, the world average efficiency of fossil fuel-based power changes over time and has risen from around 36% in 2000 to over 40% today. Moreover, given the much higher efficiency of the most modern power plant (e.g. the thermal efficiency of a modern gas turbine plant is above 55%), the global average is expected to increase in the future.

Therefore, to better assess primary energy trends, we use a time-dependent thermal equivalence model. The conversion factor used each year to calculate the ‘input-equivalent’ consumption for a given level of generation is based on a simplified representation of measured average efficiency levels:

The table below quantifies these assumptions (rounded to 1 decimal place):

Thermal equivalent efficiency factors used to convert non-fossil electricity (excluding biomass powered electricity) to primary energy

| Year | Efficiency factor (%) | Year | Efficiency factor (%) | |

|---|---|---|---|---|

| 2001 | 36.2 | 2012 | 38.8 | |

| 2002 | 36.5 | 2013 | 39.1 | |

| 2003 | 36.7 | 2014 | 39.3 | |

| 2004 | 36.9 | 2015 | 39.5 | |

| 2005 | 37.2 | 2016 | 39.8 | |

| 2006 | 37.4 | 2017 | 40.0 | |

| 2007 | 37.6 | 2018 | 40.2 | |

| 2008 | 37.9 | 2019 | 40.4 | |

| 2009 | 38.1 | 2020 | 40.5 | |

| 2010 | 38.4 | 2021 | 40.6 | |

| 2011 | 38.6 | 2022 | 40.7 |

In this year’s Statistical Review, we use the updated the thermal equivalent efficiency factor to convert electricity generation from biomass to primary energy equivalent. Prior to 2022, the same factor was used for biomass as for all non-fossil electricity. From 2022 onwards, we assume a constant efficiency of 32% for biomass power to better reflect the actual efficiency of biomass power plants.

Primary energy consumption is reported in net terms. The gross calorific value to net calorific value adjustment is fuel-specific.

Fuels used as inputs for conversion technologies (gas-to-liquids, coal-to-liquids and coal-to-gas) are counted as production for the source fuel and the outputs are counted as consumption for the converted fuel..

Total proved reserves of oil are generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing economic and geological conditions.

The data series for proved oil reserves in this year’s review does not necessarily meet the definitions, guidelines and practices used for determining proved reserves at company level, for instance as published by the US Securities and Exchange Commission nor does it necessarily represent the EI's view of proved reserves by country. Rather the data series has been compiled using a combination of primary official sources and third-party data.

Oil reserves include field condensate and natural gas liquids as well as crude oil. This inclusive approach helps to develop consistency with the oil production numbers published in the Review, which also include these categories of oil. The reserves and R/P ratio for Canada includes Canadian oil sands and the reserves and R/P ratio for Venezuela includes the Orinoco Belt.

Liquid hydrocarbon fuels from non-hydrocarbon sources, such as ethanol from corn or sugar or synthetic oil derived from natural gas (so-called GTL or gas-to-liquids), are not included in either the reserves or production series.

We have provided a detailed explanatory note on reserves clarifying current definitions and terminology.

R/P ratios represent the length of time that those remaining reserves would last if production were to continue at the previous year's rate. They are calculated by dividing remaining reserves at the end of the year by the production in that year.

Reserves-to-production (R/P) ratios are available by country and feature in the table of oil reserves. There is a time series of crude oil reserves from 1980, which can be found in the Excel workbook. Data are measured in thousand million barrels.

Please note that these reserves tables have not been updated this year.

Oil production data includes crude oil, shale oil, oil sands, condensates (lease condensate or gas condensates that require further refining) and NGLs (natural gas liquids – ethane, LPG and naphtha separated from the production of natural gas). Excludes liquid fuels from other sources such as biofuels and synthetic derivatives of coal and natural gas. This also excludes liquid fuel adjustment factors such as refinery processing gain. Excludes oil shales/kerogen extracted in solid form.

The split of crude/condensate and natural gas liquids figures are available. The crude condensate table includes crude oil, shale/tight oil, oil sands, lease condensate or gas condensates that require further refining. Excludes liquid fuels from other sources such as biomass and synthetic derivatives of coal and natural gas. The NGLs table includes ethane, LPG and naphtha separated from the production of natural gas. Excludes condensates.

World oil production tables are available in both thousand barrels daily and million tonnes.

Oil consumption as defined in previous Statistical Reviews (i.e. including biofuels) has been renamed ‘liquids’ consumption and a table is still included on this original basis. In addition, more granularity has been included on the product split of both oil products and biofuels (breaking out ethane & LPG and naphtha in oil products and the ethanol/biodiesel split of biofuels).

Total liquids consumption comprises inland demand plus international aviation and marine bunkers and refinery fuel and loss. Consumption of biogasoline (such as ethanol), biodiesel and derivatives of coal and natural gas are also included.

Oil consumption figures include inland demand plus international aviation and marine bunkers and refinery fuel and loss. Consumption of biogasoline (such as ethanol), biodiesel and derivatives of coal and natural gas are excluded. Derivatives of coal and natural gas are included.

Oil product consumption – Gasoline includes motor and aviation gasoline, gasolines and light distillate feedstock (LDF). Diesel/gasoil includes marine gasoil. ‘Fuel oil’ includes marine bunkers and crude oil used directly for fuel. ‘Others’ consists of refinery gas, solvents, petroleum coke, lubricants, bitumen, wax, other refined products and refinery fuel and loss.

Data are supplied in both exajoules and thousand barrels daily figures.

The key crudes quoted are Brent, West Texas Intermediate (WTI), Nigerian Focados and Dubai in US$ per barrel.

The spot crude price history from 1972 and annual crude price history from 1861 are available in the historical data excel workbook.

The redistribution or reproduction of data whose source is S&P Global is strictly prohibited without prior authorization from S&P Global.

Email: [email protected]

The refinery capacity data presented in this Review represents the sum of reported atmospheric crude distillation and condensate splitting capacity. Capacity should comprise the amount of input that a distillation facility can process under usual operating conditions, taking into account scheduled downtime. Figures are in thousand barrels daily at year end per calendar day.

Refinery throughputs are based on the quantity of crude and condensate processed in atmospheric distillation units and condensate splitters. Figures are in thousands of barrels per day.

The refining margins presented are benchmark margins for three major global refining centres: US Gulf Coast (USGC), North West Europe (NWE – Rotterdam) and Singapore. In each case they are based on a single crude oil appropriate for that region and have optimized product yields based on a generic refinery configuration (cracking, hydrocracking or coking), again appropriate for that region. The margins are on a semi-variable basis, i.e. the margin after all variable costs and fixed energy costs.

The tables exclude the intra-area movements of oil (for example, crude oil and products moving between countries within Europe). They do not include biofuels. Bunker fuel is not included as exports. Crude imports and exports include condensates. Saudi Arabian exports from 1980 are also available in the oil trade movements table in the Excel workbook. The split of crude oil and products are detailed. Data in the tables are in million tonnes and thousand barrels per day.

Total proved reserves of natural gas are generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing economic and operating conditions.

The data series for proved natural gas reserves in this year’s Review does not necessarily meet the definitions, guidelines and practices used for determining proved reserves at company level, for instance as published by the US Securities and Exchange Commission nor does it necessarily represent the EI's view of proved reserves by country. Rather, the data series has been compiled using a combination of primary official sources and third-party data.

Although every effort is made to come up with a consistent series for reserves based on a common definition, different countries use different methodologies and the data have varying levels of reliability.

R/P ratios represent the length of time that those remaining reserves would last if production were to continue at the previous year's rate. They are calculated by dividing remaining reserves at the end of the year by the production in that year.

As far as possible, the data represents standard cubic metres (measured at 15°C and 1013 mbar) and have been standardized using a gross calorific value (GCV) of 40 MJ/m3.

There is a time series of natural gas reserves, which can be found in the Excel workbook. Data are measured in billion cubic metres.

Please note that these reserves tables have not been updated this year.

Gas production comprises marketed production and excludes gas flared or recycled gas. Includes natural gas produced for gas-to-liquids transformation.

As far as possible, the data above represents standard cubic metres (measured at 15°C and 1013 mbar); as they are derived directly from tonnes of oil equivalent using an average conversion factor and have been standardized using a gross calorific value (GCV) of 40 MJ/m3, they do not necessarily equate with gas volumes expressed in specific national terms.

Natural gas production is provided in three different units of measurement to accommodate regional customary usage. World natural gas production PDF tables are in both billion cubic metres, and exajoules. Data in the Excel workbook are also in billion cubic feet per day (bcf/d).

Natural gas consumption excludes natural gas converted to liquid fuels but includes derivatives of coal as well as natural gas consumed in gas-to-liquids transformation.

As far as possible, the data above represents standard cubic metres (measured at 15°C and 1013 mbar); as they are derived directly from tonnes of oil equivalent using an average conversion factor and have been standardized using a gross calorific value (GCV) of 40 MJ/m3 they do not necessarily equate with gas volumes expressed in specific national terms. The difference between these world consumption figures and the world production statistics is due to variations in stocks at storage facilities and liquefaction plants, together with unavoidable disparities in the definition, measurement or conversion of gas supply and demand data.

Consumption data in the PDF data table is in billion cubic meters (bcm) and exajoules, data in billion cubic feet per day (bcf/day) can be found in the Excel workbook.

Annual prices are given for benchmark natural gas hubs together with contracted pipeline and LNG imports. The benchmark hub prices incorporate US (Henry Hub), Canada (Alberta), Netherlands TTF index and the UK (NBP). Contract prices are represented by LNG imports into Japan, the Japan Korea Marker (JKM) and Average German Import Prices.

The prices for LNG and European border are calculated as CIF prices, where CIF = cost + insurance + freight (average freight prices) in US dollars per million British thermal units (Btu).

Trade flows are on a contractual basis and may not correspond to physical gas flows in all cases. The data illustrates the flow of pipeline natural gas and LNG between sources of production and the regions of consumption. As far as possible, the data represents standard cubic metres (measured at 15ºC and 1013 mbar) and has been standardized using a gross calorific value (GCV) of 40 MJ/m3.

Total proved reserves of coal are generally taken to be those quantities that geological and engineering information indicates with reasonable certainly can be recovered in the future from known deposits under existing economic and operating conditions.

Total proved coal reserves are shown for anthracite and bituminous (including brown coal) and sub-bituminous and lignite.

Reserves-to-production (R/P) ratios represent the length of time that those remaining reserves would last if production were to continue at the previous year's rate. They are calculated by dividing remaining reserves at the end of the year by the production in that year. The R/P ratios are calculated excluding other solid fuels in reserves and production.

R/P ratios are available by country and feature in the table of coal reserves. R/P ratios for the region and the world are depicted in the chart above and the Energy charting tool. Coal reserve data is in million tonnes.

Please note that these reserves tables have not been updated this year.

Coal production includes data for commercial solid fuels only. Included in the hard coal category are bituminous and anthracite (hard coal). The sub-bituminous coal includes lignite and brown coal. Other commercial solid fuels are also included. The data includes coal produced for coal-to-liquids and coal-to-gas transformations.

In the coal production PDF table, the units are in exajoules. The data can also be downloaded from the Excel workbook in million tonnes.

Coal consumption includes data for solid fuels only. Included in the hard coal category are bituminous and anthracite. The sub-bituminous coal includes lignite and brown coal. Other commercial solid fuels are also included. The figures exclude coal converted to liquid or gaseous fuels, but includes coal consumed in transformation processes.

Differences between world consumption figures and the world production statistics are accounted for by stock changes, and unavoidable disparities in the definition, measurement or conversion of coal supply and demand data.

Annual prices quoted include the Northwest Europe marker price, Japan steam spot CIF price, China Quinhuangdao spot price and the US Central Appalachian coal spot price index. Coal prices except for the US Central Appalachian price are calculated as CIF prices, where CIF = cost + insurance + freight (average freight prices). The US Central Appalachian price is FOB = free on board. All prices are quoted in US dollars per tonne.

IHS Northwest Europe prices for 1996-2000 are the average of the monthly marker, 2001-2017 the average of weekly prices. IHS Japan prices basis = 6,000 kilocalories per kilogram NAR CIF. Chinese prices are the average monthly price for 2000-2005, weekly prices 2006-2017, 5,500 kilocalories per kilogram NAR, including cost and freight (CFR).

Commercial solid fuels only, i.e. bituminous coal and anthracite (hard coal), and lignite and brown (sub-bituminous) coal, and other commercial solid fuels. Intra-area movements (for example, between countries in Europe, Other CIS, Other Africa, Other Asia Pacific) are excluded.

The data are based on gross generation and not accounting for cross-border electricity supply. ’Input-equivalent’ energy is the amount of fuel that would be required by thermal power stations to generate the reported electricity output.

Details on thermal efficiency assumptions are available here.Data for the units are in exajoules in the PDF. The data are available in the Excel workbook in terawatt–hours (TWh).

The data are based on gross generation and not accounting for cross-border electricity supply. ‘Input-equivalent’ energy is the amount of fuel that would be required by thermal power stations to generate the reported electricity output.

Details on thermal efficiency assumptions are available online.In the hydroelectricity consumption PDF table, the units are in exajoules. The data are available in the Excel workbook in terawatt-hours (TWh).

The data are based on gross generation and not accounting for cross-border electricity supply. ‘Input-equivalent’ energy is the amount of fuel that would be required by thermal power stations to generate the reported electricity output.

Details on thermal efficiency assumptions are available online.Renewable power is based on gross generation from renewable sources including wind, geothermal, solar, biomass and waste, and not accounting for cross-border electricity supply.

The data includes biogasoline (such as ethanol) and biodiesel. Volumes have been adjusted for energy content.

The biofuels PDF tables are in thousand barrels of oil equivalent per day figures. The data are available in additional units in the Excel workbook.

Electricity generation is based on gross output.

Carbon emissions from primary energy use are estimated by applying the Default CO2 Emission Factors for Combustion to the consumption of each energy product type (coal, natural gas and various oil products) from the list of IPCC emission factors. Biofuels are considered as not emitting CO2, consistent with the practice of the IEA. Second, the revised method takes account of fuel consumption used for non-combustion purposes, such as the use of oil products and natural gas in the petrochemicals industry or of oil to produce bitumen for road construction. Estimates of the share of non-combusted fossil fuels taken from the IEA’s energy balances are subtracted from the total consumption of fossil fuels before applying the relevant emission factors.

Carbon emissions from flared natural gas are calculated using data series on volumes of gas flared from two sources: Cedigaz up to 2012, and the Payne Institute for Public Policy, Colorado School of Mines, from 2013 onward. Payne Institute’s data include flaring from upstream, downstream oil and gas, while Cedigaz include flaring from upstream only. Volumes of gas flared have been standardised using a Gross Calorific Value (GCV) of 40 MJ/m3. The IPCC Default CO2 Emission Factor for Combustion for natural gas (56,100 kg CO2 per TJ) is used and perfect combustion has been assumed. These emissions represent around 1% of total CO2 emissions.

Data for methane emissions associated with the production, transportation and distribution of fossil fuels for 1990-2020 are sourced, where available, from IEA (2021, 2022) Greenhouse Gas Emissions from Energy (all rights reserved). For a selected number of fossil fuel-producing countries where methane emission data is not currently available, an estimate of historical methane emissions has been derived using regional average methane intensity of production. For 2021, methane emission estimates are derived for all countries using methane intensity of fossil fuel production in 2020. Total methane emissions at a global and regional level show a discrepancy with IEA data due to non-inclusion of residual emissions i.e. emissions which have not been allocated to named countries. There is a wide range of uncertainty with respect to both current estimates of methane emissions and the global warming potential of methane emissions. To ensure alignment with financial and government reporting standards, the methane to CO2e factor is a 100-year Global Warming Potential (GWP) of 25, recommended by the IPCC in AR4.

Carbon emissions from industrial processes refer only to non-energy CO2 emissions from cement production and are sourced for 1990-2021 from Andrew, R. M. (2019) Global CO2 emissions from cement production, 1928-2018. Earth System Science Data 11, 1675-1710, (updated dataset May 2022).

Total proved reserves of minerals are generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known resources under existing economic and geological conditions.

The data series for mineral reserves in this year’s review does not necessarily meet the definitions, guidelines and practices used for determining proved reserves at company level nor does it necessarily represent the EI's view of proved reserves by country. Rather the data series has been compiled using a combination of primary official sources and third-party data.

KPMG firms offer audit, tax and advisory services in 143 countries and territories across the globe. It's our people who make the difference. Every day, they're helping organisations across every sector accelerate their digital transformation, manage risks, drive forward with their ESG strategies and drive sustainable growth.